Optimize your home’s equity with HomeSafe

Whether you are looking for the maximum payout, a line of credit, interest rate options, flexible ways to access your payments, or even the ability to boost your purchasing power, the HomeSafe suite of jumbo reverse mortgages are solutions tailored to you.

What HomeSafe can do for you

Do more in life

With a jumbo reverse, tap more from your high-value home so that you can put it toward your goals.

Fixed-rate option

Lock in historically low rates and unlock your stored housing wealth.

Line of credit option

An alternative to HELOC, made for retirement—monthly payments are not required*.

Be ready for what’s next

Financial flexibility allows you to jump on opportunities and limit risk to your retirement plan.

Hypothetical Scenario

How HomeSafe

maximizes retirement potential

Lucas built a lifestyle he’s passionate about backed by the strength of his housing wealth.

For illustrative purposes, let’s look at a hypothetical situation. As a nature lover and avid sailor, Lucas always saw himself retiring on the water. But with children and grandchildren near his current home, he put off moving away from his community a few more years and steadily saved for relocation. When his timeline was threatened by a knee injury and its expenses, Lucas searched for a path forward.

Hypothetical Scenario

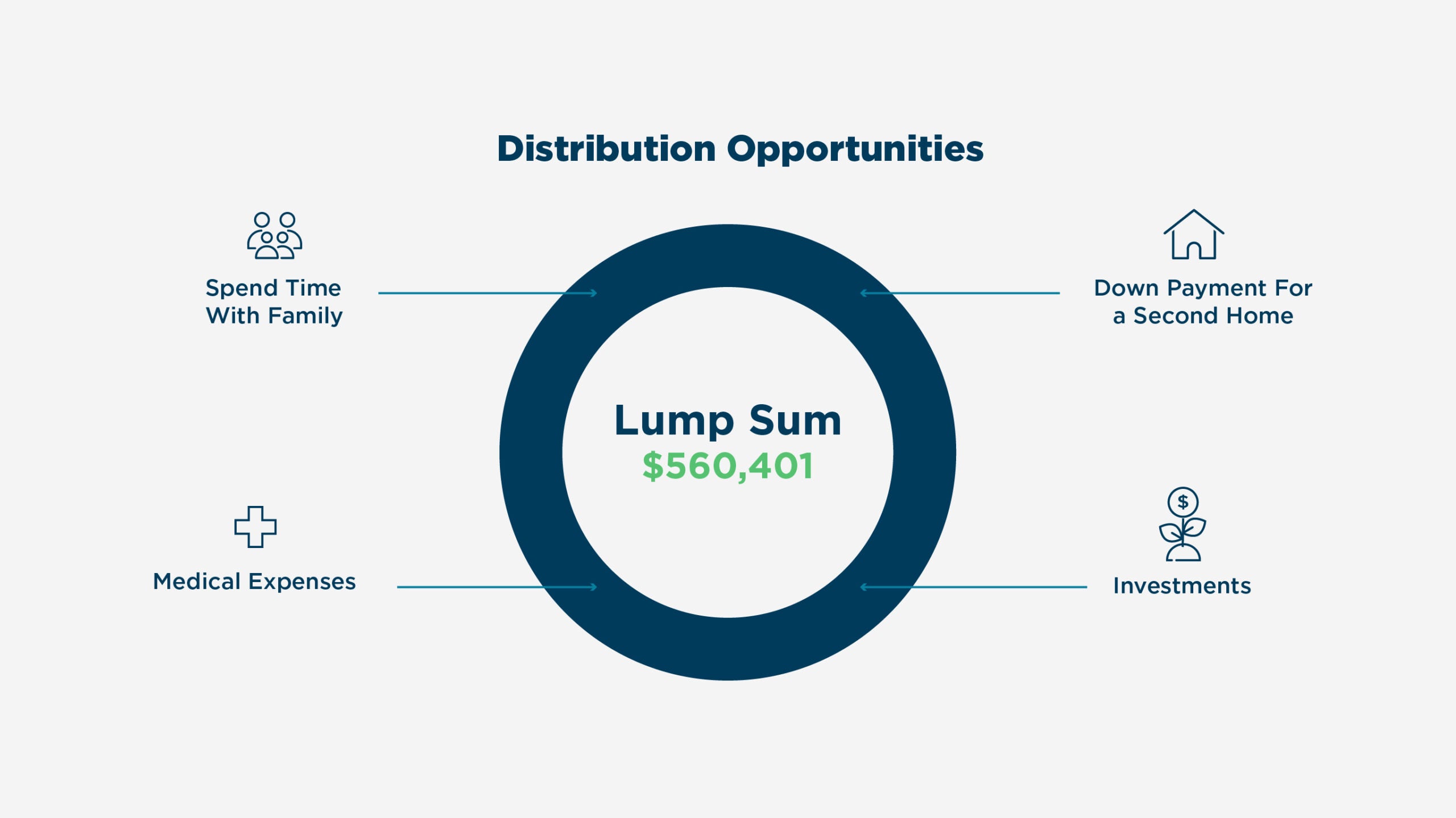

HomeSafe by the numbers

The right tool for the dream.

When Lucas used HomeSafe to pull out cash at the same time as eliminating monthly payment obligations*, he was able to tackle several major goals—covering unexpected medical costs without impacting his investments and purchasing a second home on the lake.

Scenario is for illustrative purposes only. For loan assumptions and additional disclosures related to this scenario, click here.

Loan terms potentially available to a borrower are based on factors such as loan product, home value, mortgage payoffs, location, borrower age, interest rate and payment option selected, and borrower’s credit profile.

Frequently asked

questions

The reverse mortgage borrower must meet all loan obligations, including living in the property as the principal residence and paying property charges, including property taxes, fees, hazard insurance, as well as homeowners association fees, if any. The borrower must maintain the home. If the borrower does not meet these loan obligations, then the loan will need to be repaid.

A reverse mortgage is a loan that enables homeowners and homebuyers age 55* or older to convert some of their home equity into cash or a line of credit. Some loans also let homeowners finance a new home purchase. With a reverse mortgage, you make no loan payments. You continue to live in and own your home.

Unlike a traditional home equity loan or home equity line of credit (HELOC), you don’t have to repay a reverse mortgage until the home is sold or the last surviving borrower (or a non-borrowing spouse who meets certain requirements) no longer lives in the home, as long as you meet loan obligations. The homeowners must maintain the condition of the home and stay current with property taxes and hazard insurance.

*For certain HomeSafe®️ products only, excluding Massachusetts, New York, and Washington, where the minimum age is 60, and North Carolina, Texas, and Utah, where the minimum age is 62.

We offer HomeSafe products in the following states.

HomeSafe Standard:

Arizona

California

Colorado

Connecticut

District of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Louisiana

Massachusetts

Michigan

Missouri

Minnesota

Nevada

New Jersey

New York

North Carolina

Ohio

Oregon

Pennsylvania

Rhode Island

South Carolina

Texas

Utah

Virginia

Washington

HomeSafe Select:

California

Colorado

District of Columbia

Florida

Georgia

Hawaii

Illinois

Michigan

Minnesota

Missouri

New Jersey

Nevada

North Carolina

Ohio

Oregon

Rhode Island

South Carolina

Texas

Utah

Virginia

- HomeSafe loan limits are higher than the government-insured HECM loans, up to $4 million, while offering similar protections and features to the borrower.

- HomeSafe borrowers enjoy no mortgage insurance premiums, competitive fixed interest rates*, and no out-of-pocket funds required beyond the appraisal (except for purchase). Fees and closing costs are typically rolled into the loan amount.

*For HomeSafe® Standard loans.

- You must be a homeowner 55* or older with some equity.

- The amount of loan proceeds depends on the borrower’s age, interest rate, loan payoff, location, credit profile, the appraised value of the home, and the type of HomeSafe® you choose.

- Proceeds pay off your current mortgage, and you can get the remainder as cash.

- As long as you continue to pay your taxes and insurance and uphold the terms of the loan, you keep the title to your home and live there payment-free. The loan is not due until the last living borrower leaves the home or the home is sold.

- With room in your budget after eliminating mortgage payments and cash in hand, you can create a retirement you feel good about.

*For certain HomeSafe® products only, excluding Massachusetts, New York, and Washington, where the minimum age is 60, and North Carolina, Texas, and Utah, where the minimum age is 62.

Ready to Get Started?

Let’s Go*The reverse mortgage borrower must meet all loan obligations, including living in the property as the principal residence and paying property charges, including property taxes, fees, hazard insurance. The borrower must maintain the home. If the borrower does not meet these loan obligations, then the loan will need to be repaid.