HomeSafe Scenario Additional Legal Disclosures

Lucas fixed rate, full draw HomeSafe Standard

Loan Assumptions

Illustrations are for educational purposes only and reflects a fixed-rate, full draw HomeSafe loan, a borrower age 72 who resides in California with a home value of $1,250,000, a fixed interest rate of 6.99% (7.230% APR), and financed closing costs of approximately $3,349.45 (of which $863.90 are finance charges and $2,485.55 are other charges). Borrower’s required mortgage payoff is $115,000. Loan has an initial principal limit of $678,750 and borrower receives $560,400.55 cash at closing. Rate quote generated on 7/21/2022; this rate could change or not be available at commitment or closing.

Loan Fees

Closing fees that are finance charges include a flood certificate, document preparation fee, MERS registration fee, tax verification fee, settlement/closing fee, recording services, notary fee, and counseling fee. Other closing charges include third party fees such as an appraisal fee, credit report fee, title insurance lender premium, recording charges for mortgage, recording transfer or release fee. Closing fees vary depending upon the location and value of the home.

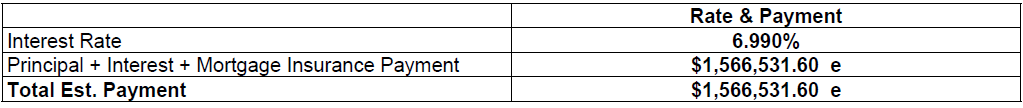

Interest Rate and Payment Summary

The disclosed amounts marked with an “e” are estimates and assume that the borrower’s loan will be due and payable upon reaching life expectancy or, if there is more than one Borrower, the life expectancy of the youngest borrower. However, the borrower’s loan will be due and payable upon the first to occur of any of the Maturity Events contained in the Loan Agreement. The disclosed amounts assume full repayment of the amount advanced plus accrued interest, although the amount the borrower may be required to pay is limited by the borrower’s agreement.

Other Information about this Loan

The loan does not require regular monthly installment repayment obligations of principal and interest, however, accrued interest will be added to the loan account, negative amortization will occur, and a borrower’s equity in their home may decrease over time. Borrower is responsible for paying their property charges which include real estate taxes, homeowners’ insurance and homeowners association fees, if any, among other applicable property charges, must maintain the home, and must occupy the home as their principal residence. If the borrower does not meet these or other loan obligations, the loan must be repaid.

The loan is subject to underwriting and an appraisal of the home. In applicable states, if the borrower has a median credit score below 600 or does not satisfy certain financial assessment requirements, some loan proceeds must be set aside to pay for property charges during the term of the loan and this will increase the interest rate. Also, in applicable states, if an appraisal reveals the need for certain property repairs, loan proceeds may need to be set aside to pay for such repairs to the home during the first year of the loan.

The HomeSafe® reverse mortgage is a proprietary product of Finance of America Reverse LLC and is not affiliated with the Home Equity Conversion Mortgage (HECM) program. Not all HomeSafe® products are available in every state. Please contact us for a complete list of availability.