EquityAvail Scenario Additional Legal Disclosures

EquityAvail Retirement Mortgage With a Fixed Rate

Loan Assumptions

The monthly mortgage payments listed here do not include taxes and insurance, which must also be paid, and any actual monthly payment will be higher. Illustration is for educational purposes only and assumes a borrower age 62 who resides in California with a home value of $950,000, a non-jumbo loan with a fixed interest rate of 7.050% (7.068% APR), financed closing costs of approximately $7,822 (of which $1,465 are finance charges). Borrower receives a $25,080 lump sum distribution at closing and has a beginning EquityAvail loan balance of $475,950. Rate quote generated on 7/27/2022; this rate could change or not be available at commitment or closing. Existing traditional 30-year mortgage being compared assumes a 3.25% interest rate (3.35% APR) with a $443,048 remaining principal balance and 192 fully amortizing payments remaining on the loan term.

Loan Fees

Closing fees that are finance charges include a flood certificate, document preparation fee, MERS registration fee, tax verification fee, settlement/closing fee, recording services, notary fee, and counseling fee. Other closing charges include third party fees such as an appraisal fee, credit report fee, title insurance lender premium, recording charges for mortgage, recording transfer or release fee, and an initial escrow payment due at closing. Closing fees vary depending upon the location and value of the home.

Terms of Repayment

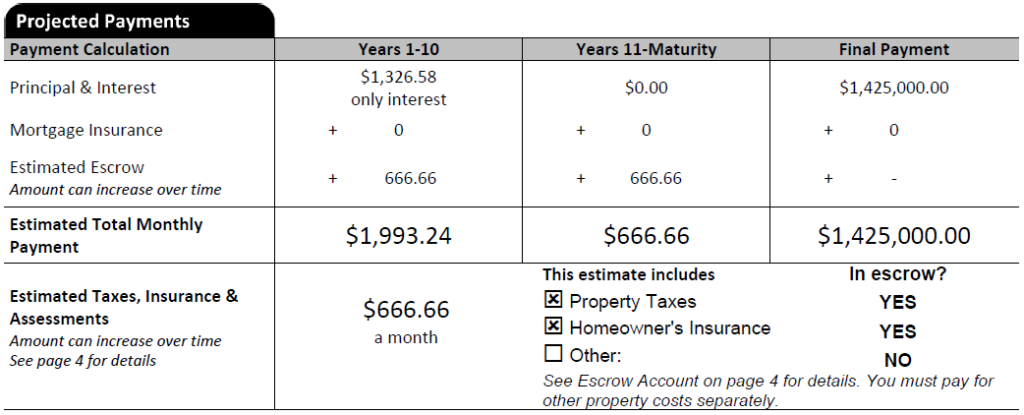

Note: The final payment listed above is the maximum amount that could be due when this loan matures. Actual final payment will depend upon the loan term.

Payment Requirements For This Loan

Borrower is required to make a monthly payment during the first one hundred and twenty (120) months of the loan (“Monthly Payment”). The Monthly Payment will only cover a portion of the interest that will accrue on the loan each month; accrued interest that is not paid monthly will be added to the principal balance of the loan, which will result in negative amortization and reduce the borrower’s equity in the home. Assuming all Monthly Payments have been made and Lender has not call the loan immediately due and payable, borrower will no longer be required to make Monthly Payments of interest after the Monthly Payment Period. Interest will continue to accrue each month, and unpaid interest will be added to the principal balance of the loan, which will result in negative amortization and reduce the borrower’s equity in the home.

The loan may be called due and payable if the borrower fails to pay taxes and insurance on the property, fails to make Monthly Payment during the Monthly Payment period, or another event of default occurs, such as failure to maintain the property. Otherwise, the loan will mature (and be due and payable in full) when the last remaining borrower occupying the home passes away, the property is sold, or the borrower and any co-borrower fail to occupy the Property as their primary residence for more than 60 days.

Escrows for Taxes and Insurance

Borrower will be required to pay taxes and insurance on the Property throughout the entire term of the loan by making monthly “escrow” payments to Lender for property taxes and insurance. Upon written request from borrower, Lender may waive the requirement that borrower make these escrow payments if certain conditions are met and after borrowers have had their loan for at least five years. If approved, borrower will be required to pay the taxes and insurance on the Property directly to the taxing authority and the insurance company.

EquityAvail is a proprietary product of Finance of America Reverse LLC and is not affiliated with the Home Equity Conversion Mortgage (HECM) program. Primary occupancy only. Not available in all states. Additional terms and conditions apply. Ask a licensed loan officer for more details.